Published January 15, 2026

Why Your Phone Explodes After a Credit Check — and How to Protect Yourself When Buying a Home

Why Your Phone Explodes After a Credit Check — and How to Protect Yourself When Buying a Home

If you’re planning to buy a home, one of the first steps is getting pre-qualified or pre-approved for a mortgage. What many buyers don’t expect is what can happen next:

Nonstop phone calls. Text messages. Emails from lenders you’ve never heard of.

If this has happened to you, you’re not alone—and it doesn’t mean something went wrong.

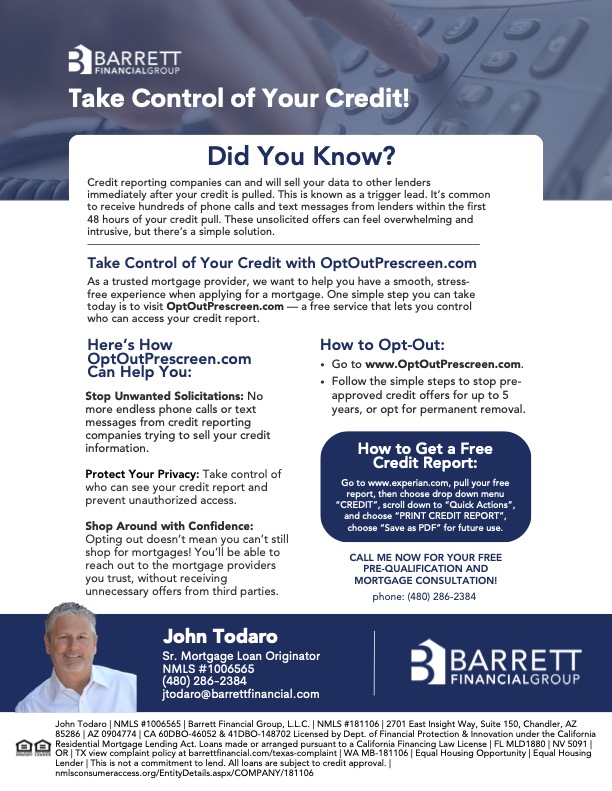

The Truth About “Trigger Leads”

When your credit is pulled for a mortgage, credit bureaus are legally allowed to sell that information as what’s called a trigger lead. This alerts other lenders that you’re actively shopping for a loan.

As a result:

- Your contact information may be sold immediately

- Multiple lenders can start calling within 24–48 hours

- Some buyers receive dozens of calls per day

These lenders are not connected to your real estate agent or your chosen lender. They are simply reacting to your credit inquiry and trying to win your business—often using urgency or pressure tactics.

Why This Is a Problem for Buyers

Beyond being annoying, trigger leads can:

- Create confusion about who you should trust

- Lead to misleading loan terms or bait-and-switch offers

- Add unnecessary stress to an already important financial decision

Buying a home should feel exciting and informed—not overwhelming.

The Simple Solution: Opt Out Before or After Your Credit Is Pulled

There is a free, official, and legal way to stop most of these unwanted solicitations.

OptOutPrescreen.com is the consumer-authorized website backed by the credit bureaus that allows you to limit who can access your credit information.

By opting out, you can:

- Reduce unwanted calls, texts, and emails

- Protect your personal financial information

- Focus on working with professionals you choose

You can opt out for five years or choose a permanent opt-out.

How to Opt Out of Trigger Leads

The process takes just a few minutes:

- Visit www.OptOutPrescreen.com

- Follow the instructions to opt out of prescreened credit offers

- Keep a confirmation for your records

This does not prevent you from getting a mortgage or shopping for rates—it simply stops third-party companies from contacting you without permission.

Will Opting Out Affect My Mortgage Approval?

No. Opting out:

- Does not lower your credit score

- Does not stop lenders from approving you

- Does not limit your ability to shop for the best loan

You can still work with reputable lenders, compare options, and move forward confidently—without the noise.

Get a Free Copy of Your Credit Report Before You Buy

Being proactive about your credit is one of the smartest things you can do before buying a home.

You’re entitled to a free credit report at:

www.experian.com

Once there:

- Choose “Credit” → “Quick Actions” → “Print Credit Report”

- Save a PDF for future use and review it carefullyCatching errors early can save time, money, and stress later.

Catching errors early can save time, money, and stress later.